Does the Government need your taxes to fund its policies?

NO.

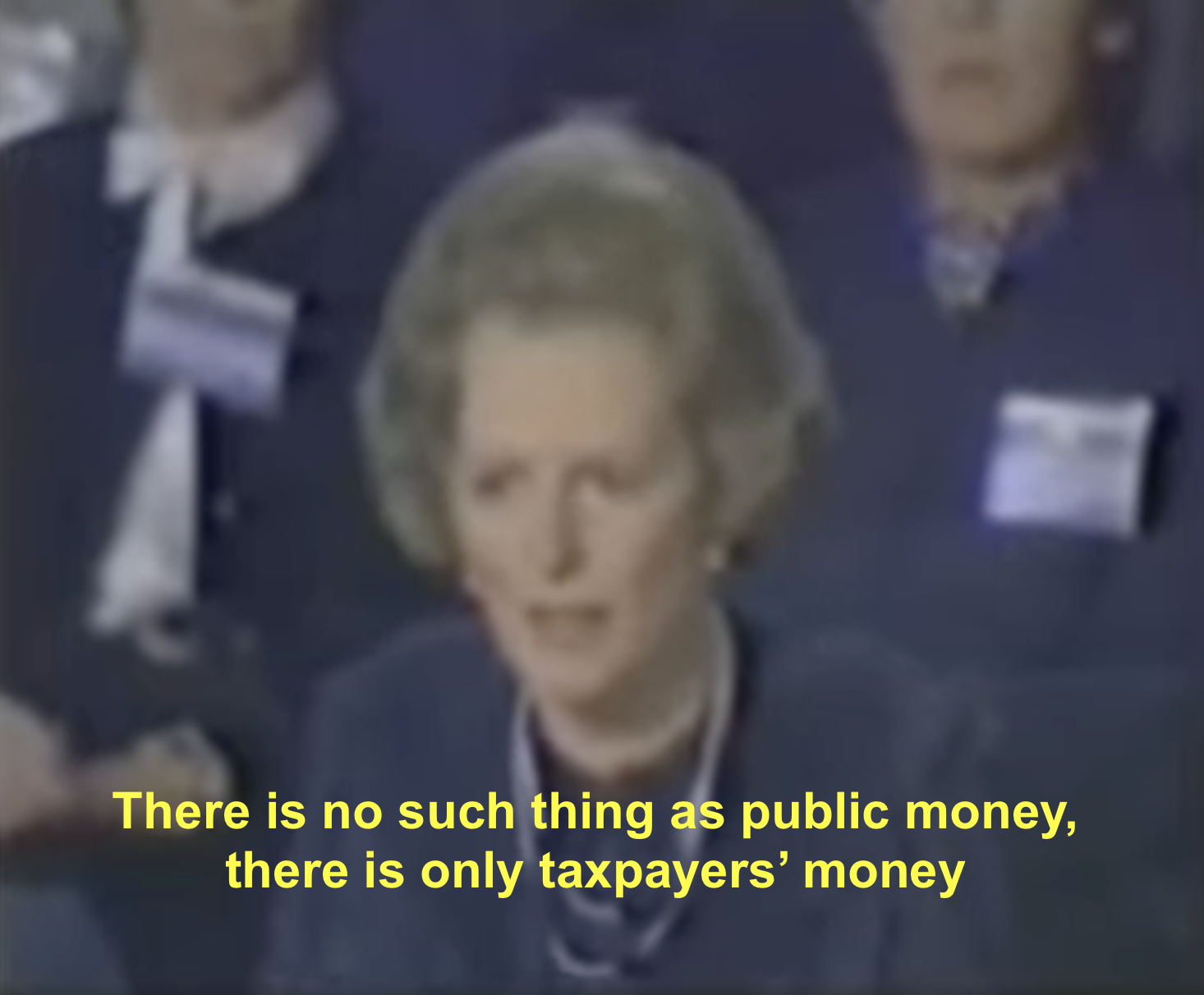

Margaret Thatcher's statement above is another in the list of things she was wrong about.

Modern monetary theory (MMT) is a macroeconomic theory that describes how monetary systems work and it advocates that government spending should not be restrained due to the fear of rising debt. 1

Governments who are sovereign issuers of their own fiat currencies, spend first, tax later (but there are some who propose that MMT can work at the sub-national level too).

You would have no money if Governments did not first create and issue it.

Governments have the ability to issue the currency needed to fund their policies to address inequality, ensure full employment, combat climate change, and have good health and education systems. As long as it is done in a way where a nation's resources are mobilised in a way that does not cause excessive inflation (government spending doesn't exceed the economy's productive capacity). Like how the US Government funded its mobilisation of its population and economy for the second world war.

Care should be taken to ensure that any spending does not further exacerbate any existing inequality by money simply ending up in the hands of the already wealthy (as may have occurred after the GFC and during COVID-19).

So, do we need to tax billionaires to get the money needed for Government policies?

NO. "Tax the wealth. Sure. But not to get their money! By conflating the tax revenue with the capacity of governments to provide services etc, progressives just advance the conservative framing and agenda." - Bill Mitchell

The tax extreme wealth to increase funds for government spending narrative just reinforces neoliberal framing

For a complete understanding of MMT, here are some resources:

Finding the Money MMT documentary featuring Stephanie Kelton

Stephanie Kelton's book the Deficit Myth

Bill Mitchell and Warren Mosler's Excellent Adventure

Steve Grumbine's MMT podcast Macro N Cheese