Its an ill bird that fouls its own nest: Superannuation and stealing our children's future

Where we invest our money, the goods, the services, the infrastructure, where the capital flows, will shape how our future unfolds.

Superannuation (pension funds) are currently worth approximately USD 63 trillion. This is around 55% of market capitalisation of all listed domestic companies (USD 114 trillion).

An amount significant enough to influence the direction of world equity markets.

If we invest in fossil fuels, gambling, tobacco, weapons, activities that pollute the environment or cause deforestation, and other activities that cause harm to humans and animals etc. we risk creating a dystopian, dirty, militaristic, and ultimately unsustainable world. If we invest in clean energy and infrastructure, poverty alleviation, sustainable land use and food production, and energy efficient transport and buildings etc. we can create a better and sustainable future.

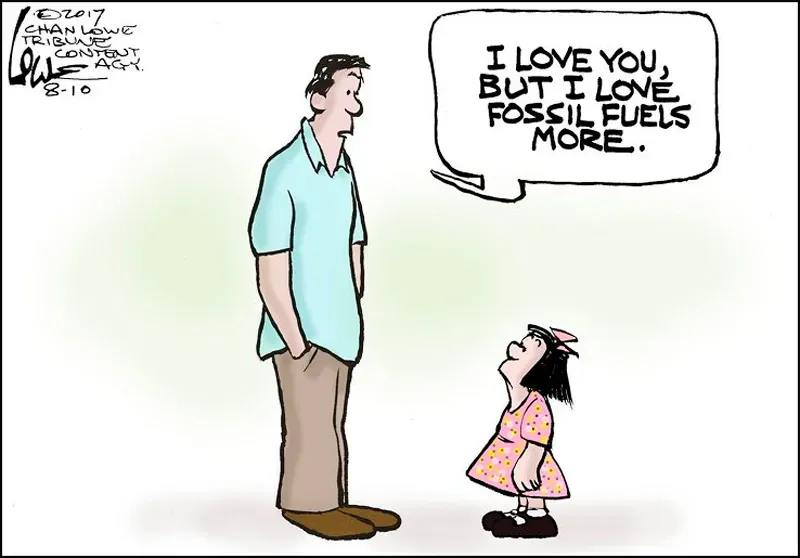

So why do some parents look for the highest current returns when choosing a superannuation fund regardless of the impact of those investments when they could choose an ethical fund that provides high returns and ensures a better future for our children?

"Hey, there are great returns on gas now that Russia has invaded Ukraine."

"Yes, but why do I want to profit off people's misery and invest in an energy source that makes climate change and our children's future so much worse."

You may get a little more money in the next 5 years for your retirement, but what about your children who retire in 50 years time? What kind of world is the financing of your retirement creating?

The financial flows currently entering superannuation funds need to shift to investments that address climate change, that invest in sustainable agriculture, that invest in clean energy and infrastructure, that invest in public transport, and other ethical and sustainable investments.

We can do this through divestment or the threat of divestment: shift our superannuation to an ethical investment option within our current fund, or even better, shift to an ethical fund like Australian Ethical. Or let your superannuation fund know that if it doesn't divest from harmful activities that you will shift funds.

And we can get involved in shareholder activism: become individual shareholders and use our collective votes to negotiate with these companies, and participate in campaigns and shareholder resolutions with organisations like Market Forces and the Australasian Centre for Corporate Responsibility to influence the allocation of capital by these companies towards sustainable outcomes.

Why our retirement savings and Australia's Future Fund are gambled on the vagaries of the stock market in the first place, when they could be held as public funds to invest directly in health, education, agriculture, clean energy and infrastructure, to serve our future needs, is another question, for another day.

You can find a guide to shareholder activism here.